The Facts About Bank Reconciliation Uncovered

Wiki Article

Bank Reconciliation - An Overview

Table of ContentsAll About Bank CodeLittle Known Questions About Bank Definition.Bank Statement - The FactsThe Ultimate Guide To Bank Draft Meaning

You can additionally save your cash and also make interest on your investment. The money kept in the majority of savings account is government insured by the Federal Deposit Insurance Firm (FDIC), up to a limitation of $250,000 for specific depositors and $500,000 for jointly held deposits. Financial institutions additionally provide credit score chances for people as well as companies.

Banks make an earnings by billing even more rate of interest to debtors than they pay on interest-bearing accounts. A financial institution's dimension is figured out by where it is situated and who it servesfrom little, community-based organizations to big industrial financial institutions. According to the FDIC, there were simply over 4,200 FDIC-insured industrial financial institutions in the USA since 2021.

Convenience, interest rates, and fees are some of the aspects that aid consumers choose their liked banks.

The Basic Principles Of Banking

The regulatory environment for banks has actually considering that tightened up considerably as an outcome. U.S. financial institutions are controlled at a state or national level. State banks are managed by a state's division of financial or division of monetary institutions.

You ought to take into consideration whether you wish to maintain both business as well as personal accounts at the exact same financial institution, or whether you want them at different financial institutions. A retail financial institution, which has fundamental banking solutions for consumers, is the most appropriate for everyday banking. You can pick a standard financial institution, which has a physical structure, or an on-line financial institution if you do not want or require to physically visit a bank branch.

, for instance, takes deposits and provides locally, which might supply a more tailored banking partnership. Choose a practical location if you are choosing a bank with a brick-and-mortar Get the facts location.

What Does Bank Account Do?

Some financial institutions additionally provide smart device applications, which can be helpful. Some huge financial institutions are moving to end over-limit fees in 2022, so that could be a vital consideration.Money & Development, March 2012, Vol (bank account). 49, No. 1 Establishments that compare savers and debtors aid make certain that economies work smoothly YOU have actually obtained $1,000 you do not require for, say, a year as well as intend to gain income from the money up until then. Or you intend to get a residence and need to obtain $100,000 and pay it back over thirty years.

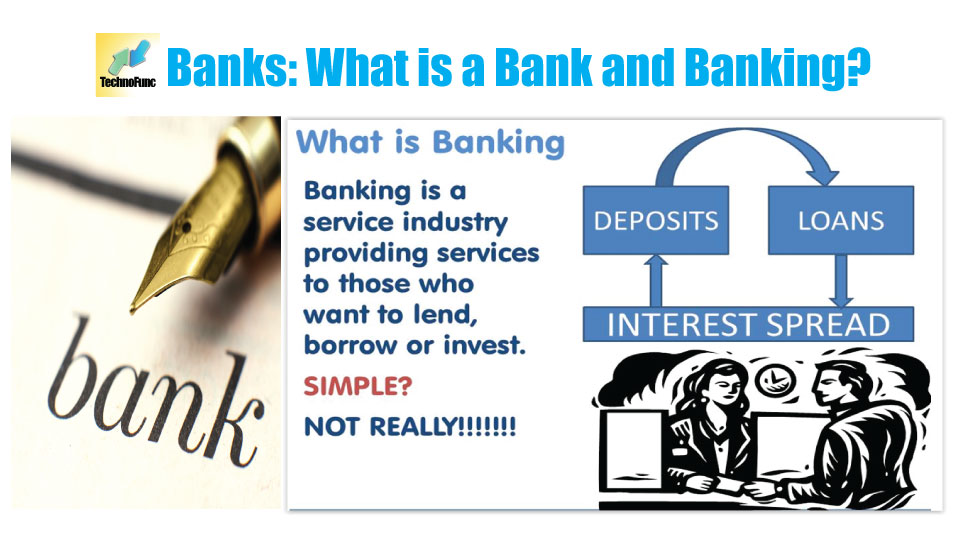

That's where financial institutions can be found in. Banks do lots of points, their main function is to take in fundscalled depositsfrom those with money, pool them, as well as lend them to those who need funds. check my reference Banks are intermediaries in between depositors (that offer cash to the financial institution) and also consumers (to whom the financial institution provides money).

Down payments can be readily available on need (a checking account, for example) or with some constraints (such as cost savings as well as time down payments). While at any type of given minute some depositors require their money, many do not.

Getting The Bank Definition To Work

The process entails maturation transformationconverting short-term liabilities (deposits) to long-lasting possessions (lendings). Banks pay depositors less than they receive from borrowers, as well as that difference represent the bulk of banks' income in many nations. Financial institutions can complement typical deposits as a source of funding by directly borrowing in the money and also resources markets.

Financial institutions keep those called for reserves on down payment with main banks, such as the United State Federal Get, the Bank of Japan, and also the European Reserve Bank. Financial institutions create cash when they offer the remainder of the cash depositors provide. This cash can be utilized to purchase goods and services and can find its means back right into the financial system as a down payment in one more bank, which then can offer a portion of it.

The dimension of the multiplierthe amount of money developed from a first depositdepends on the quantity of cash banks have to go on get (banking). Financial institutions additionally offer as well as recycle excess money within the financial system and also produce, distribute, and also trade safeties. Banks have numerous methods of making money besides swiping the difference view website (or spread) in between the rate of interest they pay on deposits and also borrowed cash as well as the rate of interest they collect from consumers or safeties they hold.

Report this wiki page